3 Blue Chip Tech Stocks to Buy Right Now

24K-Production/iStock via Getty Images

Written by Sam Kovacs

Introduction

Stocks dead. Crypto dead. Bonds dead. Cash dead.

Or so it would seem when you read the headlines of the past few weeks.

In a note to our members 10 days ago, I explained that it was well possible that we would not have picked an exact bottom for the S&P 500 (SPY), and that it could dip lower.

That has come to pass. The S&P dipped lower, but now has recovered somewhat again.

Surely, it is time to cut and run?

Quite the opposite, in fact.

In this article, I will present how you can still win big when all goes wrong and offer 5 brilliant stocks to buy in the current environment.

While the markets were happy about the Fed raising rates by 75bps this week, investors are still jittery.

Yields are going up so bonds are going down? Yes.

Rates are going up so present value of equity cashflows are going down? Yes.

Inflation is going up so cash is a bad asset? Yes.

Crypto just crashed, likely not the best place to put retirement savings? Yes.

So what exactly should you do? Read on.

Why Are You Investing?

The first thing to do when you get emotional about your investments is to get your thinking brain in motion again by answering some rational, objective questions.

The first one you should ask yourself is "why are you investing?". What is the endgame? Surely, this a means to an end and not an end in itself.

If the means is to pay off credit card debt, save up for a deposit on a house for next year, or to make money before your university tuition is due, then you're in trouble.

But for the overwhelming majority of you reading this, that's not the case.

You've invested for your retirement.

You're expecting to live a financially free retirement, and you're counting on your portfolio of stocks to contribute in a major way.

Agree?

Then you need to take a long-term approach.

Just remember that what is happening is just a short blip on the path of societal progress.

Remember 2008-2009?

Everyone was tripping.

If we look at the charts of the 3 stocks I suggested in my previous article, it all looked very bad then, but seems irrelevant.

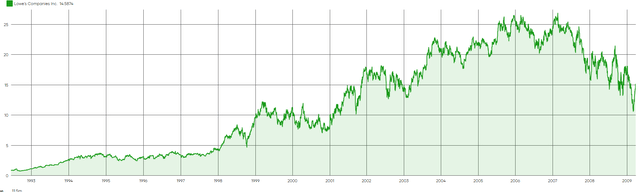

This is Lowe's (LOW) between 1992 and March 2009.

Dividend Freedom Tribe: LOW Price Chart

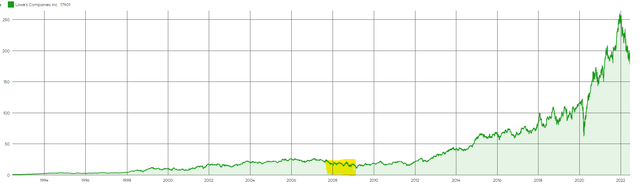

You can barely notice the dip when you add the price movement from 2009 to today.

Dividend Freedom Tribe: LOW Price Chart

I had to highlight it. But it was a 66% drop at the time, and felt very real to LOW investors at the time.

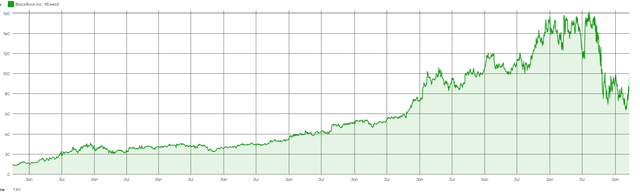

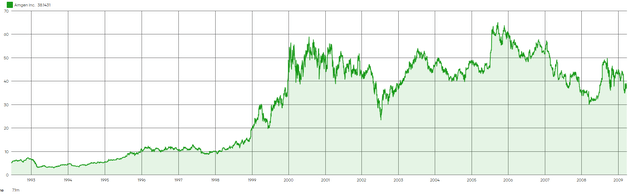

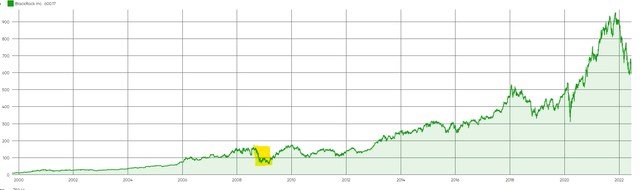

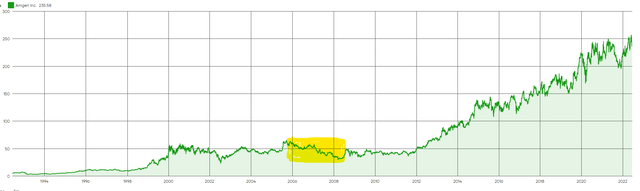

It was looking quite bleak for BlackRock (BLK) and Amgen (AMGN) too.

Dividend Freedom Tribe: BLK Price Chart

Dividend Freedom Tribe - AMGN Price Chart

Ultimately, those downturns were also just blips when you zoom out.

Dividend Freedom Tribe: BLK Price Chart

Dividend Freedom Tribe: AMGN Price Chart

So if you have time on your hands, then as long as you buy quality companies at good prices you'll do just fine.

But what if you don't have time, and need money now?

If you're counting on selling x% of your portfolio each year as financial planners liked to suggest to their clients, then you might be in a bit of trouble. Not only because the amount you need will likely be higher because of inflation, but also because the value of the portfolio you're liquidating is also likely down.

On the other hand, if you're a dividend investor, you should be totally indifferent to what is going on.

The Dividend Freedom way

Our investing methods follow what we call a "Dividends First" approach.

That means that even if everything about an investment looks good, we will only invest if a company pays enough of a yield, and grows the dividend enough, to ensure we have enough to retire on the dividend alone.

If this condition is met, and that the company is of very high quality, and is attractively priced, then you can finally sleep well at night.

The market can go up or down, but you will get paid.

Compare this to if you owned a hot dog stand. Let's say, you need to sell 200 hot dogs a day to live a comfortable life.

One of your customers loves the location of your stand, and wants to buy it from you.

But he's a bit of a lunatic, and every day, he offers a different price. One day it is $10,000. You tell him, no, after all you just bought it for $20,000 six months ago, and you know it's worth at least $25K.

The next day, he offers $20,000. You say no. He comes back and offers $5,000.

At this point you're just ignoring him, because you know you only need to sell 200 hot dogs a day to make ends meet. As long as you sell your hot dogs day in, day out, who cares about what price this guy is screaming?

That is how we approach dividend investing. As long as the dividend goes according to our expectations, the price is irrelevant.

Do not underestimate how important this is on your piece of mind. Focusing on this makes you a long term investor, and usually means you end up outperforming the index. (The Dividend Freedom Tribe's portfolios sure have been.)

And here's the rub. One day, the guy comes in and orders his hot dog. He takes a bite of it, looks up and says "screw it, I'll give you $60,000 for the place".

You realize that after tax, you could get 2 new hot dog stands and sell 400 hot dogs a day, so you take off your apron, hand it to him, and shake hands.

You buy low, you get paid to wait, and if the opportunity presents itself, you sell high.

This is how you invest to win big when everything goes wrong.

If this method sounds appealing to you, here are 3 stocks which are greatly priced, and will provide great streams of income.

3 Stocks To Win Big When All Goes Wrong

V.F. Corp. (VFC)

First on this list is V.F. Corp., a consumer discretionary stock.

I get it, some of you are thinking: What? A consumer discretionary stock when inflation is rampant? You must be nuts.

But the cycles come and go. The key question is whether or not VFC will continue to pay and increase its dividend in upcoming years at a level which is satisfactory.

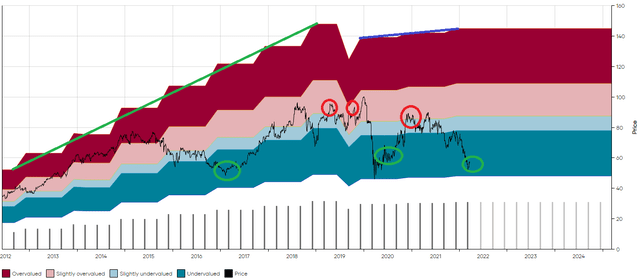

Three Months ago, in a note to members of the Dividend Freedom Tribe, I shared this chart, which shows both our Buy and Sell recommendations for VFC.

Dividend Freedom Tribe

It also highlights that since spinning off its slow brands pre-Covid (which led to the dividend decline), VFC hasn't been the high dividend growth powerhouse that some expected.

I believed that VFC was attractively priced at $57, but knew that it could go lower, which is why I suggested to members to only start dipping their toes:

Starting a position now with the option to average down over upcoming quarters is a risk I'm willing to take for exposure to a company which has existed for over a century, and seen many recessions and downturns.

The stock tanked another 20%.

Nonetheless, this year revenues are expected to increase 7% and earnings 9%.

In my mind, that will lead to at least a 5% increase in dividends, which is plenty to sustain VFC's current 4.3% yield.

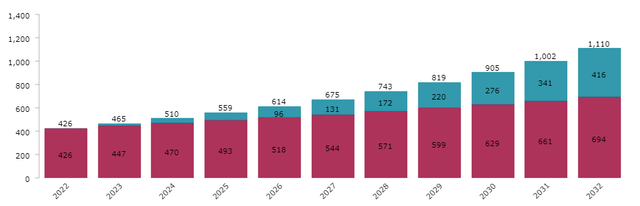

We consider that an income investment is very attractive if 10 years from the date of investment, the position yields 10% on your original investment assuming dividend reinvestments.

That means that if you invest $10K today, and reinvest dividends, then you expect $1,000 in annual income in year 10.

For VFC to hit that threshold it has a "required growth rate" of 4.5%. We calculate these required growth rates for all stocks on a daily basis which members can access in our MAD Plus companion tech tool.

If the dividend grows at 5% per annum, then income would reach 11% of original investment in year 10.

Dividend Freedom Tribe: VFC Income projection

This is very attractive. The portfolio of brands which includes TNF, Vans, Timberland, and Supreme, should continue to enjoy growth because of their entrenched moats in the streetwear space.

VFC is a buy at current prices.

EOG Resources (EOG)

Robert & Sam, those two oil bulls!

We've been bullish on oil ever since the summer of 2020, and have geared up our portfolios to reflect this since then.

Throughout the past few months however, we started taking a few gains in some positions which became overextended.

In notes to members of the Dividend Freedom Tribe, we suggested taking some gains off the table in Exxon (XOM) at $97, and in Valero (VLO) at $130.

Both of those now seem to be timely calls, as energy stocks have retreated.

We do see a possibility of a continued slump in prices for a couple months, as there are a few oddballs ahead of us which could negatively impact energy prices.

We told our members:

Why does everyone want oil to come down? It's not about everyone being unhappy with the amount they pay to get a full tank. Not when it comes to institutional investors and traders.

It is because people want the bull market to go on.

And the one way for the bull market to go on, is to get an inflation reading that comes in below the high inflation reading.

Have you noticed that the market reacted POSITIVELY to a 75bp hike in rates? (sure it slumped later, but at first it was taken positively)

That is because it was interpreted as the Fed doing the "right" thing to fight inflation.

This signals that the Fed rate hikes has a less important impact on moving markets than inflation currently does.

You know what would be good for a lower inflation reading? Oil prices coming down.

The YoY comparable is going up every month, so a decrease in oil price compounds the reduction in YoY growth, which gives the reading that people need to feel good about markets again.

OPEC+ agreement is coming to an end in August. Saudi and UAE might increase capacity. The US is still releasing its reserves aggressively, and will continue to do so until later this year in October or maybe December if they push it, when they'll have no more reserves.

Short term, these elements could cause some pressure to Oil stocks.

Beyond a few months however, there simply isn't the capacity to meet the demand which is relentless, and will likely continue to increase for another year.

A lack of investment in the space, which was fueled by the woke wave of 2020, which subsequently kicked off the inflationary cycle, means energy markets will be tight for years.

So we now see top energy companies priced at very low prices, as the market still hasn't fully woken up to the fact that these stocks are printing so much cash, some people think it should be illegal.

The UK in fact, decided energy was making too much money, and imposed a windfall tax. The U.S. has floated a similar idea. Such taxes would only limit further investment and exacerbate the problem over upcoming years.

Profitable energy companies are here to stay.

And EOG is as profitable as they get.

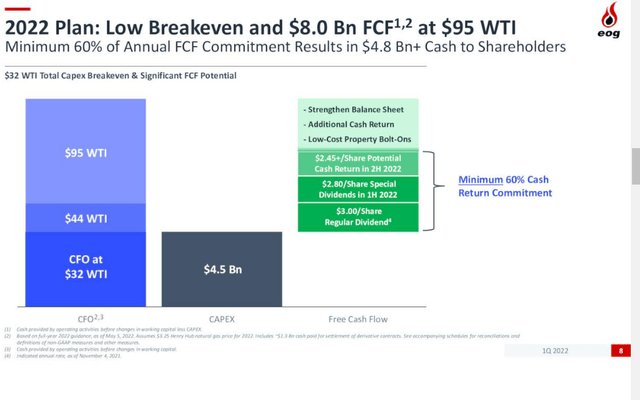

A $44 barrel is enough to sustain both its current dividend and all required operating cash and CAPEX.

EOG Investment Presentation

Every single one of the $60 extra per barrel above that is just extra cash, which the company is using to give back special dividends, bolster the balance sheet, and invest in low cost growth.

If you're going to be grumpy every time you fill the tank, at least partake in the gains.

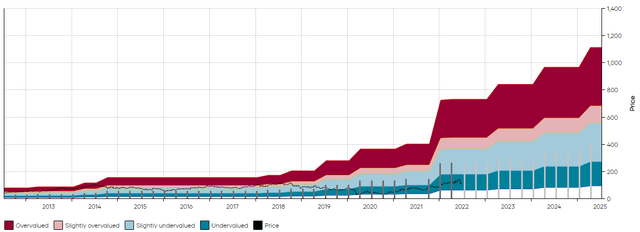

Dividend Freedom Tribe: EOG MAD CHART

EOG currently yields 2.58%, but has averaged 25% dividend growth for the past decade.

Imagine that continues, because it very well could. The dividend is only 29% of free cash flow.

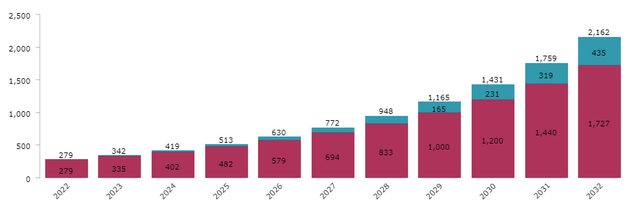

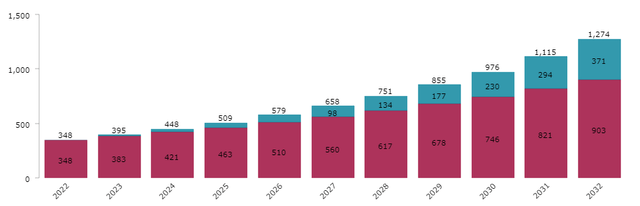

If the dividend grows at even 20% per annum, then simulating a $10K dividend investment in EOG today, assuming dividend reinvestment, then in year 10, you'd expect $2,160 in ANNUAL income, or 21.6% of your original investment.

Dividend Freedom Tribe: EOG Income Simulation

Don't be on the wrong side of history. Buy EOG.

JP Morgan (JPM)

Financials never got the break I expected them to enjoy this year.

It would have been their time, in my opinion. Rates set to continue increasing, amazing balance sheets, and consumers with resilience like in no prior recession.

But the "R word" was too much for market participants to handle. Maybe a bitter after taste of 2008-2009 leads everyone to think that recessions = banking failures.

This simply is not the case. I've said before, large American banks are no longer too big to fail, but too safe to fail.

All 34 banks in the Feds stress test would weather a severe recession. No bailouts, no cash crunches, no runs on the banks.

This is difficult for some to grasp, but it is true.

And of all the banks, none shines as bright as JP Morgan.

In a really good article by new SA author Jordan Sauer, several ways in which JPM are superior are highlighted. I selected a few snippets below.

- In a 2020 survey, respondents said JPMorgan Chase is the best bank in America.

- 23% of America's millennials reported they bank with JPMorgan Chase.

- a 4.8 star rating on The App Store.

That is the consumer side of things. Like him or not, nobody can deny that Jamie Dimon has been a sensational CEO for the company.

But the shares now yield an amount at which JPM has always been a good investment in the past decade: 3.5%.

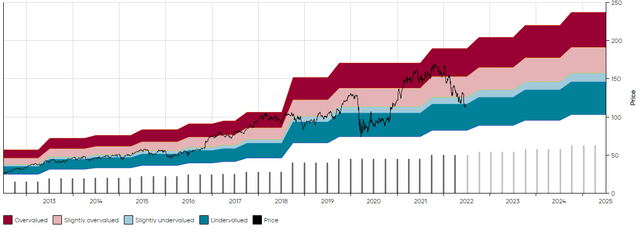

Dividend Freedom Tribe. JPM MAD Chart

At this yield, JPM only needs to increase its dividend by 7% per annum to be a great income investment, as per the requirements stated earlier in this article.

During the past years, JPM has signaled its willingness to increase dividends at double digit rates. With the payout ratio at only 29% of earnings, and income looking to increase with higher rates, which for the most part will not be passed onto consumers (more on that in a minute), it seems all too likely that JPM will be able to increase its dividend at double digits for years to come.

A 10% dividend growth rate would be very attractive for income investors. A $10K investment today, would yield $1,275 in year 10, or 12.75% of the original investment, assuming you reinvest dividends.

Dividend Freedom Triber: JPM Income Simulation

Now, on consumers.

Everyone expects a recession, but this recession would come with consumers in one of the best financial situations they've ever been in.

Consider the following from a Motley Fool article I read recently.

- While Americans in the top 10% of wealth saw cash and cash equivalents on-hand increase 32% from the end of Q1 2020 to the end of Q1 2022, people in the bottom 50% of wealth saw savings increase 45%, according to Fed data.

- Overall, US households held $17.9 trillion in cash and cash equivalents at the end of Q1 2022, a slight increase from Q4 2021 and a massive increase over the $13.7 trillion held at the end of Q1 2020, just as the pandemic was picking up steam.

For this reason, consumers are likely to default a lot less than most expect at this point.

Higher rates will also not lead to corresponding increases in deposit rates, as banks are already flush with cash and have very little incentive to increase rates to attract more cash. In turn, banks will benefit from the increase in rates.

Therefore, buying JPM now, seems like a great proposition.

Conclusion

These picks might seem controversial. A bank, an energy company, and a consumer discretionary pick when everything goes wrong.

But let's not forget that these are companies which have created nice moats in their industries, have stellar balance sheets, and have decades of corporate excellence to back them up.

Investing for the long run, you'll do great if you find investments which intersect quality, value, growth, and have brilliant dividend policies.

For us and hundreds of members of the Dividend Freedom Tribe, this is the way.

One Last Word From Us...

...If you appreciate our public articles here on Seeking Alpha, then you'll love the Dividend Freedom Tribe. You'll getunlimited MAD Charts,as well as our exclusive coverage of the entire dividend universe.

An every increasing number of members trust us and have transformed their portfolios through their membership.

Just Click Here To Learn More About The Tribe

PS: Our deep discount is expiring this weekend, don't wait.

Source: https://seekingalpha.com/article/4520174-3-controversial-blue-chip-dividend-stocks-for-when-things-go-wrong

0 Response to "3 Blue Chip Tech Stocks to Buy Right Now"

Post a Comment